Constructing a "granny flat" or garage apartment? It can be a pricey undertaking—albeit one that pays off in the long run. Make sure you're aware of these potential ADU (Accessory Dwelling Unit) costs that can sneak up on you.

Referred to interchangeably as in-law suites, garage apartments, and even "granny flats," accessory dwelling units (ADUs) have recently become a housing trend across the United States. In fact, a new national study released by Freddie Mac reveals dramatic growth in this type of construction, particularly in areas impacted by the joint forces of an affordable housing shortage and a population uptick. Freddie Mac found that 4.2% of all homes sold on MLS in 2019 included an ADU compared to a paltry 1.1% in 2000.

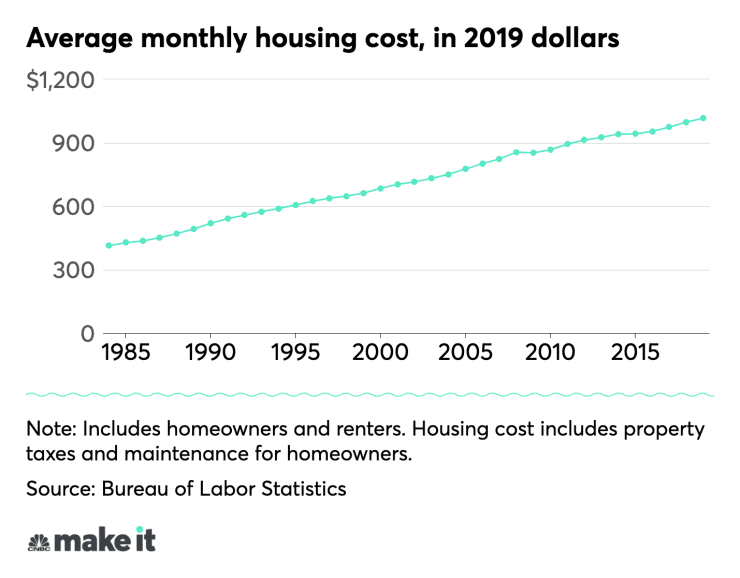

Affordable housing challenges aren’t the only factor driving the ADU boom. From a personal finance perspective, these units when used as rentals provide an incredible return on investment, according to industry experts. This is thanks to today's steep rental prices and intense demand. In some places, it’s possible to recoup your investment in an ADU in less than 10 years.

Even using an ADU to house a family member, which has become popular amid the realities of COVID-19, can be a financial win given that the cost of a monthly construction loan payment is likely to be far lower than rent on an apartment.

Still, constructing a flat or garage apartment is hardly inexpensive. An ADU is defined as a home with its own full kitchen and bathroom (as opposed to an in-home room for rent with shared amenities, for example). The construction costs of an ADU vary based on a long list of factors, including where in the country you’re building and whether you’re renovating an existing structure or starting from scratch. Overall, the price tag can range from $30,000 to more than $300,000. There are also plenty of hidden expenses to be aware of when embarking on ADU construction.

Here are some of the under-the-radar costs associated with ADU projects that you'll want to keep in mind as you contemplate whether there’s a "granny flat" in your future.

1. Utility Upgrades

Many of us live in homes that were built a few decades ago, which means the electrical panels were most likely not designed to support a second, fully functioning living unit, says Caitlin Bigelow, CEO and cofounder of Maxable, a leading provider of resources for building ADUs.

“A 100-amp panel is fairly standard for most older homes,” says Bigelow. “But in most cases, a 200-amp panel is needed when you construct an ADU in order to pull enough electricity to run two washing machines, two refrigerators, and more.” The cost of upgrading your electrical panel will likely be a few thousand dollars, says Bigelow.

2. Site Work

Getting your property ready for an ADU is another cost many homeowners don’t anticipate, says Bigelow. “Depending on what the property looks like, you might need to do a significant amount of site work,” she says. “You might need to remove a tree or level a sloped back yard, and grading is expensive if you have to get a bulldozer involved.”

3. Interior Finishes

There’s also a great deal of price variability associated with the interior finishes and design you select for your ADU. Do you want top-of-the-line kitchen appliances and custom tile? Or will it be outfitted with off-the-rack options from big-box stores like IKEA or The Home Depot?

When it comes to deciding on interior design costs, Bigelow recommends thinking carefully about how you intend to use the ADU. In other words, will you be living in it the unit yourself one day, or will it always be a rental?

“If you’re building it for yourself, you might want to splurge on special or unique finishes that you love versus when you’re building a rental, in which case you might want to look at finishes that are durable and will hold up to having renters in the unit,” says Bigelow.

4. Protracted Construction Timeline

One more unanticipated factor to keep in mind—construction timeline. Building an ADU isn’t necessarily a quick or easy project. You’ll need to review designs, meet with contractors, review bids, select finishes, and more. It takes time to plan and manage construction, which can impact how soon you will be making any money back on your investment if creating a rental.

“As a homeowner embarks on this journey, be prepared for it to take anywhere from nine to 12 months from start to finish,” says Bigelow. “There’s a lot of time that goes into these projects; it’s not like doing a kitchen remodel. It’s more involved and you need to factor that in.” Working with professionals who can help guide the process, will alleviate some of the burden, says Bigelow.

What to Know Before Constructing Your Accessory Dwelling Unit

The demand for accessory dwelling units is highest in regions of the U.S. that have been witnessing the most growth, such as the Sun Belt states of California, Florida, Texas, and Georgia, which account for half of the 1.4 million ADUs identified by the FreddieMac study. Meanwhile, Portland, Dallas, Seattle, Los Angeles, and Miami are the fastest-growing metros, each seeing double-digit growth of ADUs since 2015.

There are many factors to consider before undertaking such a significant project, including the steep price-tag of construction and the fact that ADUs cannot be sold independently from the main property.

Still, these projects can have a variety of benefits, not the least of which is the potential to generate a lucrative income stream. “A lot of people have sticker shock when they see it will cost $200,000,” says Bigelow. “But when you look at the monthly loan payment on that amount it would be about $800.”

Meanwhile, rental rates in some places have shot up significantly, such as in California, where over the past decade they’ve increased by 65%. A 550-square-foot ADU can rent for $1,300 or more in the Golden State.

When you do the math, it’s clear that you're coming out ahead financially. And as an added bonus, your property will be much more valuable overall, says Bigelow.

For more, visit Better Homes and Gardens.

If there is a home that you would like more information about, if you are considering selling a property, or if you have questions about the housing market in your neighborhood, please reach out. We’re here to help.