We have more listings, more active inventory and more sales than a year ago.

With the Easter holiday last week, data for housing inventory, new listings and the pace of new contracts started all took a breather from their growth pace. Each of those notched down from a week ago and compared to a year ago. This is a holiday effect and it should all be reversed back onto the year’s growth trend by next Monday’s report.

Here’s how 2024 is shaping up: There are now more listings, more active inventory and more sales than a year ago. What’s notable is that last year there were more immediate sales, fewer withdrawals and fewer price reductions.

The way to look at this is that demand for homes hasn’t really picked up from a year ago. Mortgage rates haven’t fallen — if anything, mortgage rates are higher than they were a year ago. So demand isn’t increasing.

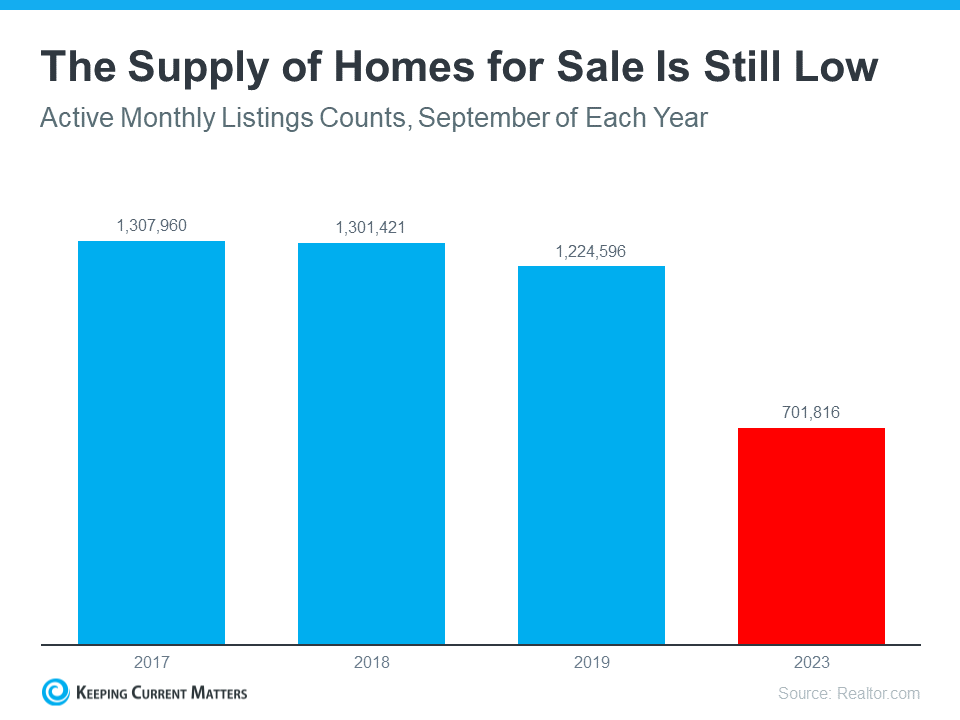

Sales are increasing because supply is increasing. We’re slowly emerging from a supply-constrained market. Sales in 2023 were held back because there were not enough homes to buy. As sellers gently re-enter the market, more home sales can happen and are happening.

This flat demand with more supply means that there are less upward pressures on home-price appreciation this year than a year ago. We finished 2023 with 3-5% home-price appreciation and it looks like 2024 will be flat for home-price gains.

Inventory

There are now 513,000 single family homes for sale on the market. That’s almost 1% fewer than the previous week, with the decline due to the Easter holiday. Inventory will climb again with this week’s data.

There remain about 25% more homes on the market now than a year ago. That’s 100,000 more single-family homes for sale now than a year ago. Some of the markets like Southwest Florida have big inventory gains, others like Boston are still just barely climbing off pandemic lows. But they’re all gaining over last year.

After this week, it’ll be interesting to watch if the year-over-year changes slow down at all. In 2023, inventory finally started climbing in mid-April and I expect our current inventory growth path to continue for a few more months. Last year there were so few sellers each week and we now observe 10-15% more sellers each week. That growth looks poised to continue.

One reason we know that inventory will keep growing is that we can measure the pre-listings. These are marketed as “Coming Soon” — they’re not actually listed for sale yet. The coming soon listings jumped by 26% this week and are 34% greater than a year ago. That tells me we’ll be back on our inventory growth pace with just this one week dip.

New listings

In the new listings data, you can most clearly see the impact of the Easter holiday. There were only 55,000 new listings last week for single-family homes. That’s down 8.5% for the week and actually 1.5% fewer than a year ago. The Easter holiday was later in April last year, so next week’s data comparison will show a big jump weekly and yearly with two easy baseline comparisons. Because of the mismatched holiday weeks, this was the first week of annual decline in new listings volume since way back at Thanksgiving.

In other words, seller growth continues. It’s not huge, but it is a real growth. And except for the mismatched holiday comparisons, it would have climbed last week, too.

We’ve consistently had more sellers easing into the market. I haven’t seen anything in the data that indicates this will change. Even as inventory builds in some parts of the country, there’s not a general surge. There’s no sign of an imbalance with too many sellers for the current demand levels.

New pendings

The holiday weekend pushed a few contracts out later too. So the new pendings dipped last week too, to just 65,000. That’s 65,000 single-family homes that took offers and started the sales process. There were another 15,000 condos that got offers last week.

That’s down 6.5% from the previous week and just fractionally fewer than the same time last year.

Just like the listings volume, the sales volume is definitely increasing. I don’t see any sign in the data of that trend changing. Like I’ve said, if we have a big jump in mortgage rates, that would slow down the sales process.

And in fact, the 10-year yield has been climbing in response to the continued strength in the economy. It seems like every macro economic data point we get makes it less likely that the Federal Reserve will cut rates soon. Those data points drive the 10-year higher, which puts pressure on the 30-year mortgage rate. The good news is that the spread between the 10-year and the 30-year mortgage rates has been compressing a bit. So even though the 10-year is up a lot, mortgage rates are only up a little.

That compressing spread is one reason that mortgage rate forecasters keep anticipating lower rates coming this year. Will it happen? I don’t know. We haven’t seen falling mortgage rates yet. The good news is that this housing market will continue to expand even if rates are just stable. They don’t have to fall.

Meanwhile, homes are spending just under 40 days in contract now. That’s less than last year at this time when it was closer to 50 days. Fewer days in contract implies a more resilient market, more likely to close and less likely to fail. It probably also is related to the increase is cash buyers we’ve seen this year. If you’re looking for bearish signs in the housing data, the days in contract is one you might pay attention to. Days in contract is lower now than a year ago and is ticking down as you’d expect for the season. Currently no notable bearish signal in that data point.

Home prices

At $395,000, prices for the latest sales (the homes going into contract) are up 5.7% over last year. Home prices are only 2% higher than where they were two years ago. At that time, the pandemic boom was ending and mortgage rates were climbing very quickly. Buyers were getting the very last of the affordable payments and the prices paid for the homes reflect that.

I want to point out that I’m sharing the pending sales data here. The active market is shifting a bit differently. The median price of all the homes on the market, which is the price data I usually share, has actually lost ground since the start of the year. The median price for all the single-family homes on the market now across the U.S. is $440,000. That’s unchanged since last year.

By that measure, home prices haven’t climbed at all in a year now. Zero percent home price appreciation. Last year, the tighter supply was leading to more upward pressure each week on the market. By that measure, we started 2024 with 3% home-price gains and right now we have 0% home price gains. When I say that home prices are looking less bullish than the sales volume numbers, this is what I’m talking about.

The asking prices are soft and are now showing no appreciation over last year. The sales prices are still showing their 5-6% annual gains that you’ll hear in the headlines.

Price reductions

Let’s close today with the leading indicator percent of the homes on the market with price reductions. Currently 32% of the single-family homes on the market have taken a price cut from the original list price. That’s up just a fraction from the previous week but it’s notably higher than last year at this time. There are more sellers now who have felt the need to cut their asking prices than a year ago. We can see slight weakness in those asking prices now.

Now, it’s not a lot of price cuts and it’s not rising super rapidly. It’s not deteriorating from here. And that’s why we do this data work each week. This market is trying to grow, but homebuyers are obviously sensitive to the cost of money.

Read more at HousingWire.com

Related Links

Newly Built Homes Could Be a Game Changer This Spring

Should you refinance your mortgage? Here are three signs it’s time, real estate experts say

How to Buy a House: 4 Ways to Purchase Faster and Smarter

If there is a home that you would like more information about, if you are considering selling a property, or if you have questions about the housing market in your neighborhood, please reach out. We’re here to help.