Job and economic expansion is boosting the next wave of first time and move-up homebuyers

From one of our fave writers at HousingWire (If you like stuff like this as much as we do, you should subscribe to their newsletter!)

For 10 years, I have held a core belief that the U.S. housing market would not fully recover in terms of mortgage demand until sometime between 2020 to 2024.

From the span of 2008 to 2019, we had the weakest new home sales and housing starts cycle ever. But, we also had the most prolonged economic and job expansion ever.

Case in point, last week the U.S. added one more stable jobs report to the streak of 112 straight months of job gains. This is the fertile economic ground to which the most massive demographic patch of 26 to 32-year-olds will come into “home-buying age.” Currently, the median first-time homebuyer age is 33. Back in 1981, it was 29.

Labor force growth for ages 25 to 54 has been on an upswing since the lows of 2015, so some of these would-be home buyers should have the economic chops necessary to enter into homeownership. The graph below shows this trend:

You’ll notice a similar trend to the purchase application data in the graph below as well.

American homeowners typically follow a well-trodden path to homeownership, albeit these days people get married and buy homes later in life. As younger Americans work longer with no recession to stop this flow, their financial profile to buy a home enhances. Here’s a look at the path of today’s first-time homebuyers:

1. We rent. After leaving the parental home for college or career, our first home away from home is usually a rental.

2. We date. We start looking to pair up with the family formation, still a vague and distant concept.

3. We mate. Usually, after a few false starts and broken hearts, we identify a mate that just might be the one.

4. We marry. Or otherwise commit to a couple-hood and a shared future.

5. We have kids. According to averaged data from the Census Bureau, in three and half years after marriage (if we make it that far), children enter the picture.

6. We buy. The first time median age home buyer is now 33. Once a baby is one the way or needs to start school, the desire to purchase and settle down becomes more pressing.

The longest economic and job expansion ever recorded in history has facilitated an excellent backdrop to go into 2020-2024 with a healthy dose of first-time buyers coming into the marketplace.

Never forget: Now more than ever, dual-income households give the housing market an extra boost.

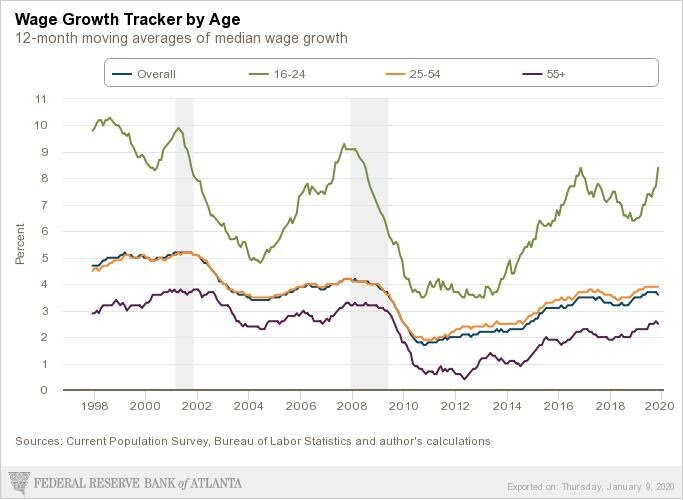

One positive thing about the longest job expansion ever is that a tighter labor market is suitable for everyone. This means wage growth, while not extremely hot, is stable year over year.

Wage growth also looks better when you account for the prime age factor into the equation in some of the wage data (see below).

Not only do we have a large demographic patch coming up, but we also have a solid 10 year base of current homeowners who bought homes with the capacity to own the debt. If this group needs to move up, which still happens every year, they’re in a lovely spot financially to do so, especially Americans who bought homes from 2010-2016.

Don’t forget home buying is a process, not something you buy on Instagram, well, not yet at least.

Having the longest job and economic expansion after the Great Recession has been a stable force for creating the next wave of first time and move-up homebuyers. The current housing trends have fewer dangerous bridges to cross for all these young Americans ages 26-32, unlike what we had in the previous economic expansion.

I don’t believe that this big demographic patch will create another housing boom but will instead provide a stable source of replacement buyers for the existing home market. The only issue we need to be concerned about is affordability… But more on that soon.

If you have questions about how this information might impact a move or investment purchase or sale that you have been considering, contact us, we’re here to talk it out!