Mortgage rates remain in a holding pattern at the start of December and the general consensus among market experts is that little will change even if the Federal Reserve implements another interest rate cut next week.

Mortgage News Daily reported that 30-year fixed-rate mortgages averaged 6.31% on Monday, virtually unchanged from a week ago.

HousingWire’s Mortgage Rates Center, which relies on locked loan data across all credit profiles, reported 30-year conventional loan rates of 6.36% on Tuesday, down 1 basis point from a week ago. Rates for 30-year loans through the Federal Housing Administration (FHA) averaged 6.13%, up 2 bps during the week, while rates for 30-year jumbo loans were down 1 bps to 6.19%.

The stable nature of mortgage rates in recent weeks is partially tied to the consistency in mortgage spreads. The spread between the 30-year mortgage rate and the 10-year Treasury rate is higher than its historic average of 1.60% to 1.80%, but at a current figure of 2.19%, it’s much lower compared to where it was in late 2023 and late 2024.

“Mortgage spreads were the unsung superheroes of the housing sector this year, because we wouldn’t have had mortgage rates near 6% without them improving,” HousingWire Lead Analyst Logan Mohtashami wrote over the weekend.

Despite the ongoing friction between employment data and inflation data that could pull the economy in opposite directions, interest rate traders are confident that the Federal Reserve will lower benchmark rates on Dec. 10.

The CME Group’s FedWatch tool shows that 87% of traders are anticipating a cut of 25 bps, which would bring the federal funds rate to a range of 3.50% to 3.75%. It hasn’t been that low since September 2022.

Bright MLS chief economist Lisa Sturtevant said last week that she didn’t expect much movement for mortgage rates even with a third straight Fed cut.

“We are entering the traditionally slowest period for the housing market. Monthly home sales are lowest in November, December and January. Listing activity slows down during the winter as prospective sellers set their sights on early spring,” Sturtevant said in written commentary.

“We are in a ‘wait-and-see’ housing market as we head into 2026. There are both buyers and sellers on the sidelines, watching not just where mortgage rates and the economy are headed, but also how confident they feel about their own personal situations.”

What will the Fed do?

Under the watch of Jerome Powell, the Federal Reserve has typically shown solidarity with its monetary policy decisions. But dissension has grown in 2025 and was evident at the central bank’s late October meeting, when Kansas City Fed President Jeffrey Schmid voted for no cut, while Gov. Stephen Miran voted for a larger cut of 50 bps.

An article published Monday by The Wall Street Journal illustrated the divide. It listed four policymakers as “more likely to favor a cut” and five who are “less likely to favor a cut.” Powell, along with Gov. Lisa Cook and Vice Chair Philip Jefferson, could serve as the swing votes as their stances are less clear.

Beyond this month, the direction of interest rates could become more divisive. President Donald Trump is expected to announce Powell’s replacement soon, with the pick likely to align with Trump’s desire for much lower rates.

Kevin Hassett is the rumored frontrunner for the Fed chair job, according to a recent report from Bloomberg. Hassett is the director of the White House National Economic Council and a Trump ally who could push for lower rates on a faster timeline. Other candidates include current Fed governors Christopher Waller and Michelle Bowman; former Fed Gov. Kevin Warsh; and BlackRock executive Rick Rieder.

Whoever takes over as chair when Powell’s term ends in May 2026 will lead similar debates over interest rate policy and its impact on housing demand. And according to Mark Fleming, chief economist at First American, there are other factors at play that will influence home sales and mortgage origination volumes next year.

“An important dynamic for affordability is that household income is expected to rise faster than house prices next year,” Fleming said. “According to the New York Fed’s Survey of Consumer Expectations, median expected household income growth is 2.8 percent. When income growth exceeds house price growth, house-buying power improves — even if mortgage rates don’t decline meaningfully.

“This is a key driver of the roughly 3 percent improvement in affordability we expect between the end of this year and end of 2026, which would return affordability to levels not seen since the summer of 2022.”

Read more at Housingwire

Related Links

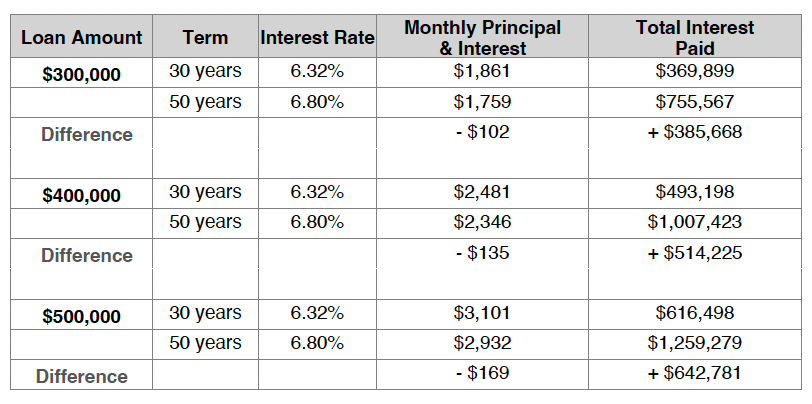

How much would a 50-year mortgage cost homebuyers?

Are mortgage buydowns a lifeline or a risk for new homebuyers?

Would You Let $80 a Month Hold You Back from Buying a Home?

If there is a home that you would like more information about, if you are considering selling a property, or if you have questions about the housing market in your neighborhood, please reach out. We’re here to help.