Homeownership has long been tied to building wealth—and for good reason. Instead of throwing rent money out the window each month, owning a home allows you to build home equity.

And over time, equity can turn your mortgage debt into a sizeable asset. You can use it to get a line of credit, a home equity loan, or a refinance. Alternatively, if you’re considering selling your house, that equity you create can be used toward purchasing your next home.

But before you can put that nest egg to use, you should understand precisely what equity is in light of today’s record-high home prices. Here’s what the experts have to say on home equity.

What is home equity?

When you initially get a mortgage, most of the equity in your home belongs to the bank. That could be 80% to 95%, depending on how much down payment you made. Every time you make a mortgage payment, the home equity portion (the amount you own outright) increases—minus any outstanding mortgage or other liens.

“Simply put, equity is the difference between the current market value of the property you own and the amount still owed on the mortgage,” says Adie Kriegstein, a real estate agent and founder of the NYC Experience Team at Compass.

Every mortgage payment you make increases your equity. However, your equity can decrease if you decide to use your equity for a line of credit or home equity loan.

Building your equity egg takes time. And depending on the market conditions, your equity can rise sharply or take a nosedive. Today, many homeowners are sitting on record-high amounts of equity because of the decade-long boom of low interest rates, up until 2022.

“As home prices increase, and so long as your debt remains constant, the equity value in your home will increase,” says Jill Fopiano, CEO of O’Brien Wealth Partners.

Home equity can be a seller’s most valuable asset

When you sell your home, the equity you built can be used to pay off the remaining mortgage balance and other debts, potentially leaving you with a profit.

Or you might decide to use the equity as a down payment on your next house—or finance other investments or expenses. And if you have a hefty equity amount, you can plop down a more significant down payment, which should qualify you for a lower interest rate.

It sounds like a win-win if you’re thinking about selling your home. But before you start counting your cash, you should determine how much equity you have and if putting your home on the market makes sense.

“By knowing their home equity, sellers can set a realistic asking price for their property and avoid overpricing or underpricing,” says Kriegstein.

How much home equity do you have?

Whether you’re putting your home on the market or staying put, knowing how your home equity and home value measure up is essential.

“This can help homeowners make informed decisions about potential home improvements or financial decisions, such as taking out a home equity loan,” says Kriegstein.

In a nutshell: Home value affects your equity and can increase when property values go up or decrease when property values fall.

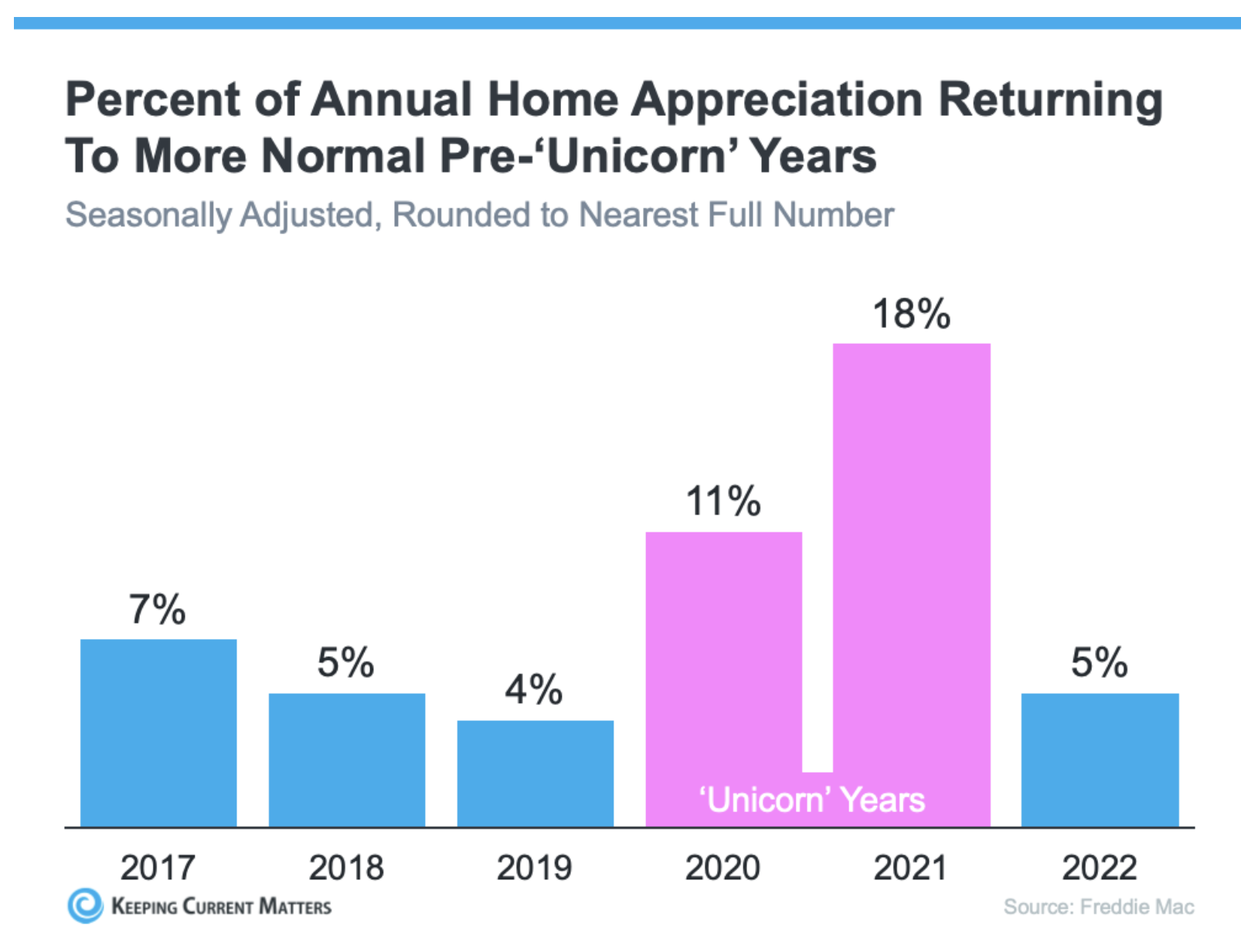

Typically, homes appreciate 3% per year. So if you’ve owned your home for a while, you’ve likely built up some equity and might not even realize how much you’re sitting on until you do a little homework.

“While the best valuation is the price a buyer is willing to pay, more viable alternatives include researching the value of your home through online sites, looking at comparable sales in your area, or ordering an appraisal,” says Fopiano.

Once you determine the value of your home, subtract any debt related to the house, such as first or second mortgage balances and home equity loans. The remainder is your equity.

So let’s say you bought your house for $200,000 and after a few years, your loan balance is $160,000. And in that time, your house value jumped to $250,000. With this simplified example, your equity is now $90,000.

How much equity you should have before selling your home

It’s vital to consider a few critical financial factors if you want to use home equity to your advantage. One is whether you have enough equity to sell your home. There isn’t a one-size-fits-all amount, but there are some general guidelines.

“One common rule of thumb is that you should have at least 20% equity in your home before you consider selling,” says Kriegstein. “If you have less than 20%, you may be required to pay private mortgage insurance, which can add significantly to your monthly mortgage payments.”

Another variable is the current market conditions.

“If the housing market is strong and demand for your home is high, you may be able to sell your home with less equity than if the market is weak and there are fewer buyers,” adds Kriegstein.

Even with these guidelines, it’s wise to speak with a trusted real estate agent and a financial planner to get a clear picture of your options—and determine whether to sell or stay put.

Keep reading on Realtor.com

Related Links

If there is a home that you would like more information about, if you are considering selling a property, or if you have questions about the housing market in your neighborhood, please reach out. We’re here to help.