Excited to hold our public grand opening on First Friday March the 4th!

Please join us as we unveil our brand new downtown office location and meet our featured artist. You can even purchase her works. We’ll have refreshments, swag, and friendly faces.

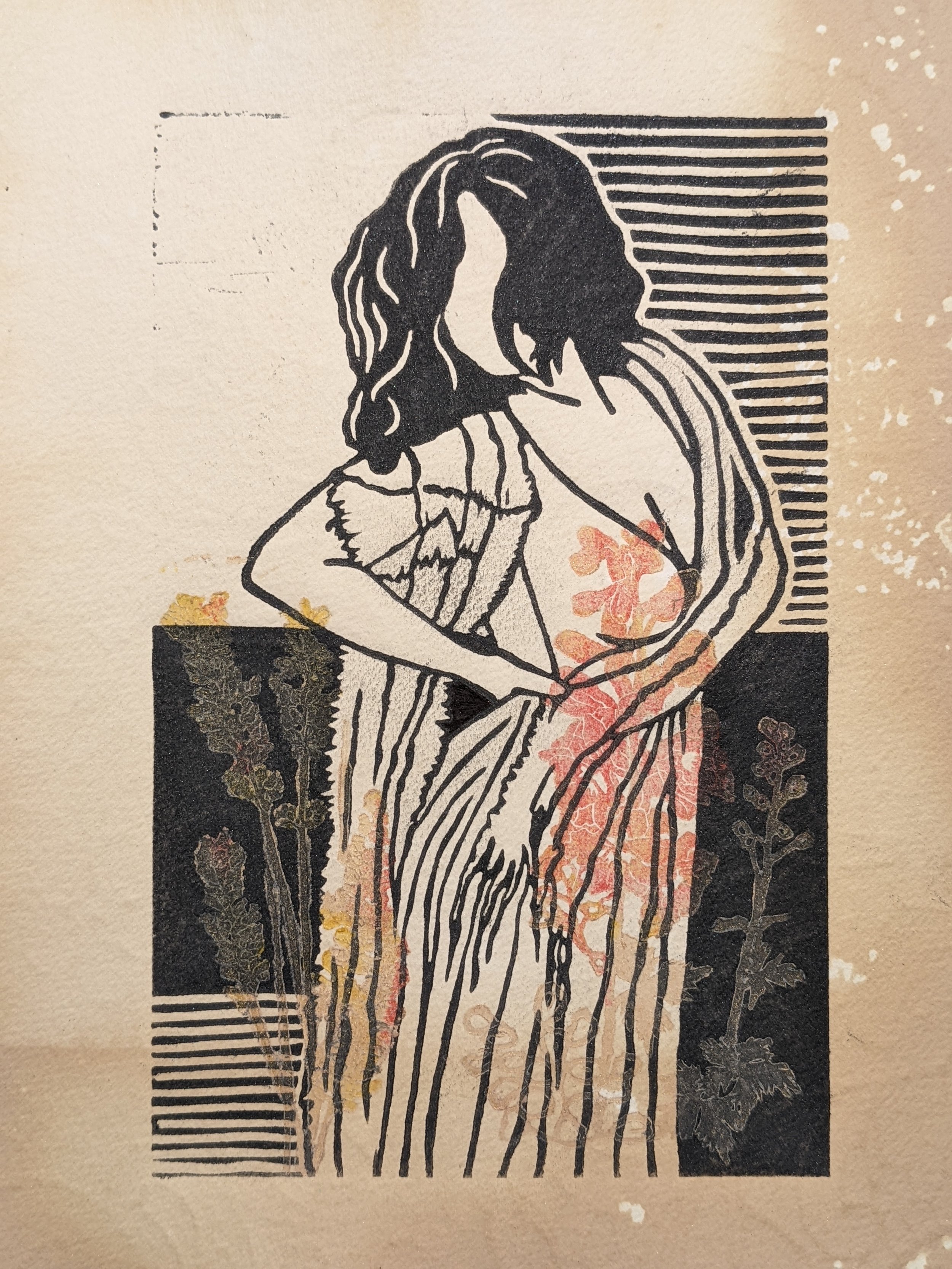

Stop by our Downtown Bend office to see some amazing art by Jeanette Small!

Jeanette Small Art

WEST + MAIN HOMES

750 NW Lava Rd. Bend, OR 97703

3.4.2022, 5-9pm

Meet Jeanette!

I am a fine artist living in Bend, Oregon, who specializes in printmaking (blockprints using Linoleum and wood carvings, and etchings) and live figure drawing. I have been leading a figure drawing lab at COCC for the past four years, have exhibited work in several galleries in Bend, have some work currently on exhibit at the High Desert Museum (part of the ROOTED show), and have some international exposure (part of group exhibits in Berlin, Germany). I have designed a book cover and several labels, contributed to textile design and artwork for music albums. I invite you to take a look at some of my work on my website jsmallart.com or visit my Instagram page @smalljeanette to see my aesthetic.

Learn more about Jeanette in our Q+A!

What are you known for?

I am primarily known in the international art community for my skills as a carver. My Linoleum carvings have been included in publications in Germany, and I have participated in juried exhibits and printmaking art exchanges all over the USA. In Bend, Oregon I am better known for teaching Figure Drawing and actively creating community. I cherish the connections I make with other creatives in our community and beyond.

What are you working on right now?

Currently I am exploring my identity through a series of self-portraits and through the artwork of other artists: drawings, paintings and photographs of me as a model. The different artistic approaches, the differing quality of gaze and conceptions of what the artist (psychologically) projects upon me create a beautiful and interesting tapestry. This project is still in its infancy, and is wonderfully energizing for me.

What are your thoughts about your city's creative scene?

Central Oregon is home to a magnificent number of gifted artists in various disciplines. I believe that our geographic area is on the precipice of becoming an important art hub on the West coast. New galleries are opening up, the subject matter of artwork is shifting away from exclusively landscapes and farm animals, the population is growing and expanding the range of tastes and desires. I want to contribute to this growth through my own artwork and through active support of our creative energy by creating and maintaining artist groups/collectives.

How did you arrive at where you are today?

I have a complex personal past about which I could (and possibly should) write volumes. Born in Eastern Europe into a German-Jewish family, I knew poverty and severe discrimination. I witnessed war, violent deaths of loved ones and loss of all possessions. My parents split up and emigrated to different countries. My mother took my younger brother and me, and we sought asylum in Germany. My father went to the USA. I came to San Francisco, CA at the age of 17 seeking to build a loving family relationship with my father and his side of the family. While my relational goals went unmet, I experienced amazing support of my artistic talent in San Francisco. I was admitted to the School of the Arts (a magnet art school with fabulous reputation and exceedingly challenging admission requirements), and was recruited by the SF Museum of Modern Art to complete a one-year internship with them culminating in a body of work that was on exhibit at the museum for over 9 months. I felt great fear in pursuing art as a career, and instead earned an academic degree in Clinical Psychology. I completed my undergraduate studies at the University of California, Santa Barbara, and earned my MA and PhD at the Santa Barbara Graduate Institute (since my graduation the school was purchased by the Chicago Institute of Professional Psychology). As a psychologist, I worked primarily with families in crisis, teenagers in foster care and homeless youth, and some young violent offenders. I managed a co-ed residential facility for persons ages 11-18 in Santa Barbara, CA. All throughout this time, I continued making art and processing my lived experience through externalized imagery. After having our first child, working with violent populations, working nights, weekends and holidays became no longer feasible. My husband's career took priority while my career as a psychology took a back seat. I continued volunteering my services to populations in need, but found much more time and resources for my artistic expression. I joined art groups, art classes, found opportunities to show and sell my artwork, found an audience curious about my explorations. At this point, I perceive myself as a professional artist and seek exposure and a platform from which to connect with more people, bring together different perspectives and foster radical acceptance.

Where do you find inspiration?

Inspiration for me is a curiosity about my lived experience. I am endlessly fascinated by nature, culture, relationships, my bodily functions, nourishment of any kind, scientific discoveries, philosophical inquiries, to name but a few. My mind wraps around new and familiar concepts and I seek to explore them further and in greater depth. I love to work in series so as to examine the different facets of the experience, concept or idea.

Get in touch with Jeanette

Website: jsmallart.com

Instagram: @smalljeanette

Special Thanks to West + Main agent Kaitlynn Jeppsen for recommending Jeanette’s work!

If you are a local artist/crafter/maker/indie business owner and would like to be featured on our blog, please fill out this form or contact Greg Fischer at greg@westandmainoregon.com with questions...we can't wait to learn all about you!