Home improvement remains a hot trend as people update their spaces to be more functional for the long-term.

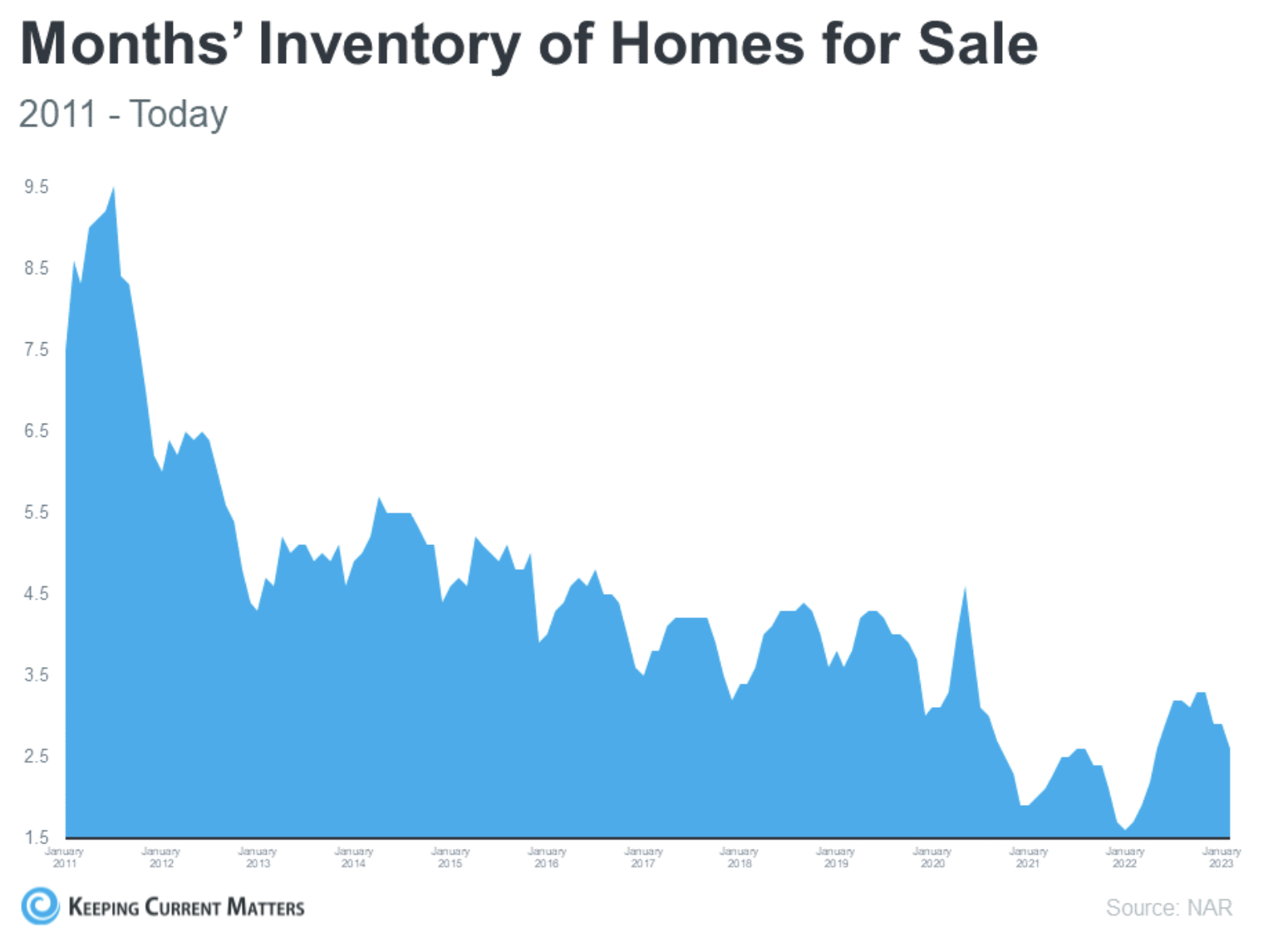

Facing lean housing inventory, more would-be move-up home buyers may be feeling stuck in place. As they wait out the market, many continue to tackle remodeling projects on their current home. In fact, remodeling activity surged to a record high last year, according to the 2023 U.S. Houzz & Home Study(link is external), a survey that reflects responses from about 46,000 homeowners. The trend is likely to continue, as more than half of homeowners surveyed say they intend to renovate this year, too, consistent with 2022 levels.

“Faced with shortages of housing stock and high interest rates, we’re seeing homeowners update their current home to make the space more functional for the long term,” says Liza Hausman, vice president of industry marketing at Houzz, a home remodeling resource. “We’re also seeing an uptick in additions, with the vast majority of homeowners hiring professionals to achieve their goals.”

Many renovating homeowners may not have intentions of reselling immediately, but they’re eyeing how much their home could be worth as the housing market pendulum swings. Sixty-two percent of owners say their main motivation for tackling a renovation is to increase their home’s value, according to a separate survey(link is external) from Cinch Home Services, a home warranty company.

Homeowners expressed concerns about selling their home in its current state, expressing fears that their home was in need of too many repairs (65%); has an outdated interior (60%); lacks trendy fixtures (38%); or lacks curb appeal (33%), according to the Cinch Home Services survey.

To combat home dissatisfaction, Houzz uncovered some recent home improvement trends that emerged from the 2022 boom.

1. Expanded living spaces. The number of renovating homeowners who are adding square footage is on the rise. The rooms most popular for expansions are kitchens, bathrooms and living rooms, the Houzz survey shows.

2. Remodeling budgets are rising. The median expense for home renovations in 2022 was $22,000—up 22% from 2021. Ten percent of owners were willing to spend six figures: $140,000 or more. Expenditures are likely rising because materials and products are getting pricier. Kitchen and bathroom renovations were the most expensive projects homeowners took on; in 2022, the median spend on a kitchen remodel reached $20,000, and $13,500 for primary bathrooms, up 33% and 50% year over year, respectively, according to Houzz.

3. Aging homes are getting upgraded. The median age of a home in the U.S. continues to rise as homeowners try to keep their properties current. Nearly 30% of homeowners upgraded plumbing, followed by electrical and home automation, the Houzz survey shows. Among home system updates, cooling and heating systems were the two largest expenditures at $5,500 and $5,000, respectively. Check out the most popular home updates based on a home’s age.

4. Contractors remain in demand. The long wait for contractors may linger in some markets because of overheated demand. Homeowners hired specialty service providers and construction professionals, such as general contractors and bathroom or kitchen remodelers, more often in 2022, the Houzz survey finds. Homeowners continue to cite “finding the right service providers” as their biggest challenge for home renovations, followed by finding the right projects and staying on budget.

5. Owners turn to loans for pricier projects. Eighty-two percent of homeowners paid for their projects using cash from their savings while 28% who used credit cards. But one trend to watch is that in 2022, the percentage of homeowners financing their renovation projects with secured home loans rose to 16% from 14% in 2021. Homeowners tackling pricier projects—from $50,000 to $200,000—are more likely to take out a loan than those with lower price tags, the study finds.

Related Links

Fannie Mae and Freddie Mac Expand Plans for Equitable Housing

Found a Dream Home Without a Garage? Here’s What To Know About Building One

If there is a home that you would like more information about, if you are considering selling a property, or if you have questions about the housing market in your neighborhood, please reach out. We’re here to help.