The spring 2023 housing market is off to a different start than its 2021 and 2022 counterparts but several factors are converging to make it not quite a typical pre-pandemic market, either.

Total existing-home sales fell 2.4% from February to a seasonally adjusted annual rate of 4.44 million in March, the National Association of Realtors said in a report last week. Year-over-year, sales activity fell 22%.

Keep your finger on the pulse of all things real estate by signing up here for The National Observer: Real Estate Edition.

But while demand for housing has slowed in the wake of mortgage-rate increases that began late spring last year, inventory remains constrained, thanks to a persistent housing shortage and fewer people putting their homes on the market after locking in a low interest rate during the pandemic.

"The housing market is making progress," said Nadia Evangelou, senior economist and director of real estate research at the NAR, adding the housing market nationally has already recovered from its lowest levels of activity in the recent cycle. "We expect the housing market to make even more progress … however, there will be more fluctuations."

Home prices continue to fall, especially in hot Sun Belt cities and gateway markets. The median U.S. home sale price fell 3.3% in March, to $400,528, Redfin Corp. (Nasdaq: RDFN) found, which is the largest annual drop since 2012. It's the second consecutive month of annual decreases in home prices since 2012, too, according to Redfin.

Places that were white-hot during the early days of the pandemic saw the biggest declines, with home prices in Boise, Idaho, falling 15.4% from a year earlier, and a 13.7% decline observed in Austin, Texas. Among major metros, Sacramento, San Jose and Oakland, California, also posted significant annual declines in home prices, at 11.9%, 10.5% and 9.7%, respectively.

But some markets are bucking the trend and actually seeing steep price increases in their listings, Realtor.com found.

Smaller markets that have historically been more affordable are seeing some of the more notable increases, such as in Omaha, Nebraska, where the median home listing price in March was $344,500 — an 80% increase from a year prior. In Davenport, Iowa, the median listing prices was nearly $220,000 in March, or a 63% increase compared to the same time a year ago.

Even with home price declines in some markets and fewer people in the market, new listings fell 23.3% year over year in March, to the lowest level on record aside from the start of the pandemic on a seasonally-adjusted basis, Redfin found. That dearth of housing on the market will likely stop home prices from falling precipitously, especially when buying activity picks back up.

Evangelou said the NAR is predicting mortgage rates will fall to less than 6% by the end of the year, which will bring more buyers to the market. The group is predicting home sales to increase by 5% in the second quarter, still lower than the same quarter a year prior.

That's in part because of trends in seasonality, Evangelou said, with more buyers in the market during the spring and summer months.

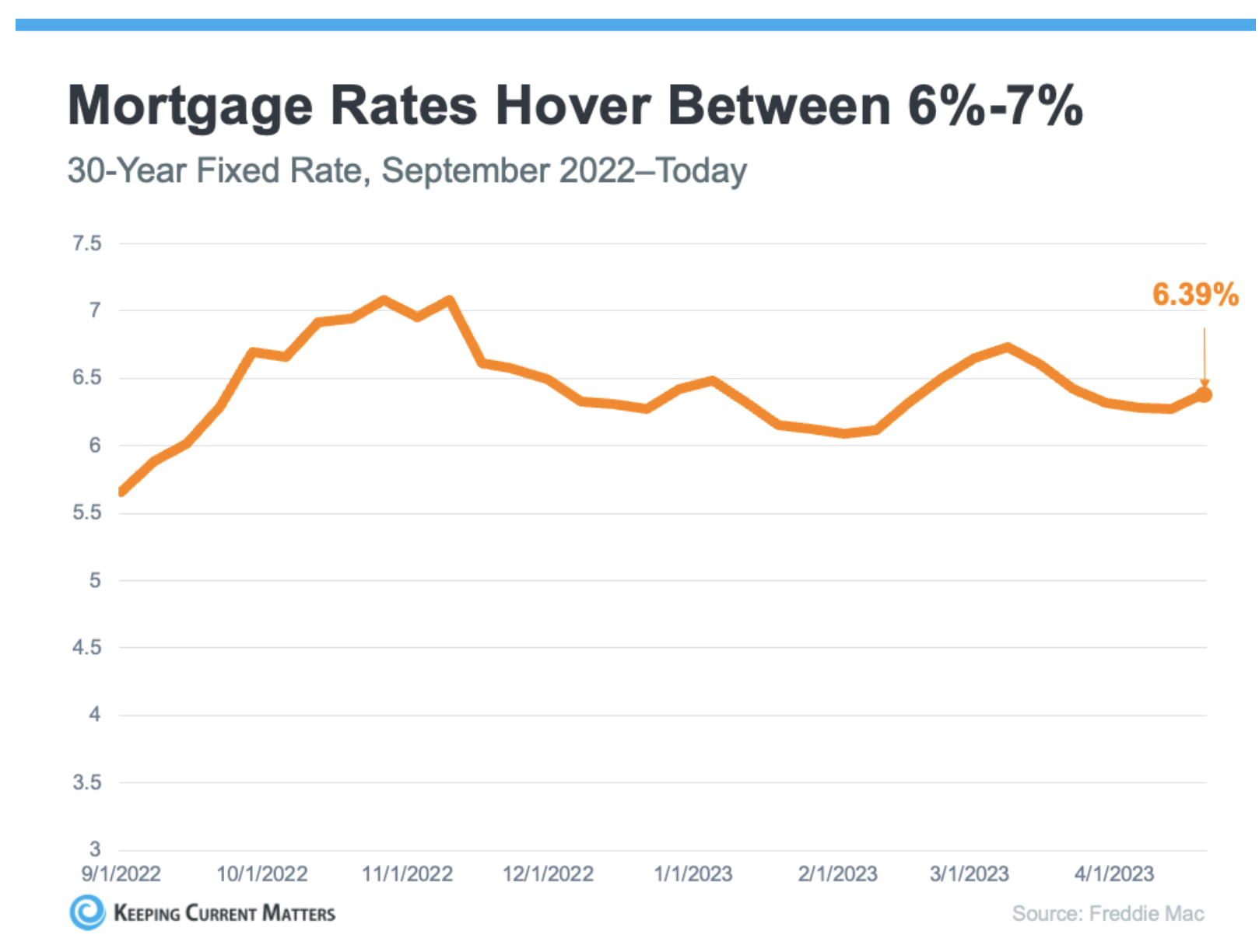

Right now, it seems buyers are locking in mortgage rates once they fall below a certain threshold, those who track the residential real estate market say — even if it's a slight dip, to some amount less than 6.5%, that's sometimes enough to compel a temporary bump in housing-market activity.

Kent Coykendall, president at San Marcos, California-based Meridian Pacific Properties, said it's peculiar to see the market fluctuating so much and how volatile mortgage rates are changing demand for houses on a weekly basis.

"The market is seeing a lot of stops and starts, more so than we normally do," he said. "(We'll have) three times as many sales (as is normal) one week, then it's quiet, then three times as many sales the next week."

There's a schizophrenic nature to the market right now, said Brian Conlon, director of business development at Meridian Pacific, thanks to rapid, unpredictable movement in the mortgage market.

It's a contrast from a year or so ago, when builders like Meridian Pacific were essentially taking orders for 18 months, Coykendall said. The company has more recently pivoted to pre-selling homes instead of building speculatively and recently inked an exclusive agreement with Coldwell Banker Collins-Maury to list, market and sell its new-construction homes.

"We weren’t even manning model houses and the orders came in," Coykendall said. "Now, we have a professional team manning open houses, we're getting into the presale business ... We're really growing up as a retail homebuilder and seller, in a normalized market."

Related Links

If there is a home that you would like more information about, if you are considering selling a property, or if you have questions about the housing market in your neighborhood, please reach out. We’re here to help.