“I’m concerned that they’re not thinking big enough in terms of how much somebody should save.”

How much are you going to need to retire? Whatever your answer, there’s a good chance you’re low-balling it, experts say.

According to a new survey from the Transamerica Center for Retirement Studies, half of millennials (born 1981 to 1996) believe that they’ll need $300,000 or less in savings to retire comfortably — a fraction of what most estimates say they’ll need.

Gen X (born 1965 to 1980) and Gen Z (born 1997 to 2012) had slightly higher estimates for their retirement needs: The median guess for each group came in at $500,000. Boomers (born 1946 to 1964) had the highest median guess, at $750,000 — which makes sense, since many of them are near or at retirement, so they have a clearer picture of what their retirement needs will be. However, even that amount probably won’t be enough to retire on in comfort, experts say.

“The estimated retirement savings for all workers are on the low side,” says Catherine Collinson, CEO and president of the Transamerica Institute, the parent foundation for the Center for Retirement Studies. “I’m concerned that they’re not thinking big enough in terms of how much somebody should save.”

So how much money do you actually need to retire comfortably? The rule of thumb is that you want an annual retirement income that’s about 75% of your pre-retirement income, according to experts.

Based on Grow’s retirement calculator, the median millennial (age 32) earning the median U.S. household income ($68,703) would need to save $1.8 million in order to retire on three-quarters of their income at age 67.

That might sound daunting, but it doesn’t have to be overwhelming. There’s plenty of help out there to get you on the right track.

Don’t estimate your retirement needs by guessing

One of the surprises for Transamerica’s researchers, who surveyed 10,000 people at the end of November 2020, was the number of people who estimated their retirement needs simply by guessing.

More than 40% of respondents said it was how they landed on the answer they gave. Only a quarter said they’d used a retirement calculator or filled out a worksheet.

“It’s surprising that people are not taking as much advantage as they can and should of the tools that are available,” Collinson says.

These tools take the guesswork out of your retirement planning and they can help you be clear-eyed about reaching your goals, Collinson says. She cites boomers, who had the highest guess about how much they would need to have saved for retirement, as an example.

Their $750,000 estimate “is much more than they’ve actually saved in all their retirement accounts,” Collinson says. The median retirement savings for boomers came in at just over $200,000, according to the survey.

In good news, more young people ‘have started saving’ for the future

The survey isn’t all doom and gloom. It contains several data points that are very encouraging, especially when it comes to how younger people are thinking about retirement. This was the first year that the survey, which has been conducted annually for more than 20 years, collected data from Gen Z, and Collinson was pleasantly surprised by its findings.

“One of the things that’s most surprising about Gen Z is that they have started saving at an age younger than their older counterparts,” Collinson says. About “7 in 10 Gen Zs are saving for retirement, and the median age they started is 19. We’ve never seen that in the survey before.”

Most Gen Zers are college-aged, and few are fully in the workforce, so things could change. That said, the way they’re thinking about retirement is “awe-inspiring,” Collinson says.

Even if you didn’t start saving for retirement at 19, now is still a great time to start. Experts suggest you set aside 15% of your income for retirement, but barring that, anything that you put away is a good thing, says Janet Stanzak, a certified financial planner and founder of Financial Empowerment in Minnesota.

“Something is better than nothing,” Stanzak recently told Grow.

One great way to start? If the company you work for offers a 401(k) program, set aside a small percentage — even 1% — of each paycheck for that account. That kind of employer-sponsored retirement savings program is “the number one best way” to get started, Stanzak says. If your job matches the contributions you make, try to contribute enough to get the entire match.

Those contributions can add up to big savings by the time you’re ready to retire. The concept of 401(k) and IRA millionaires — that is, people who have saved $1 million or more in their retirement accounts — has become a reality in recent years, as more and more people reach that milestone.

The number of 401(k) plans with a balance of $1 million or more jumped to a record high of 365,000 in the first quarter of 2021, according to data from Fidelity. The number of IRA millionaires increased to 307,600, also an all-time high.

Related Links

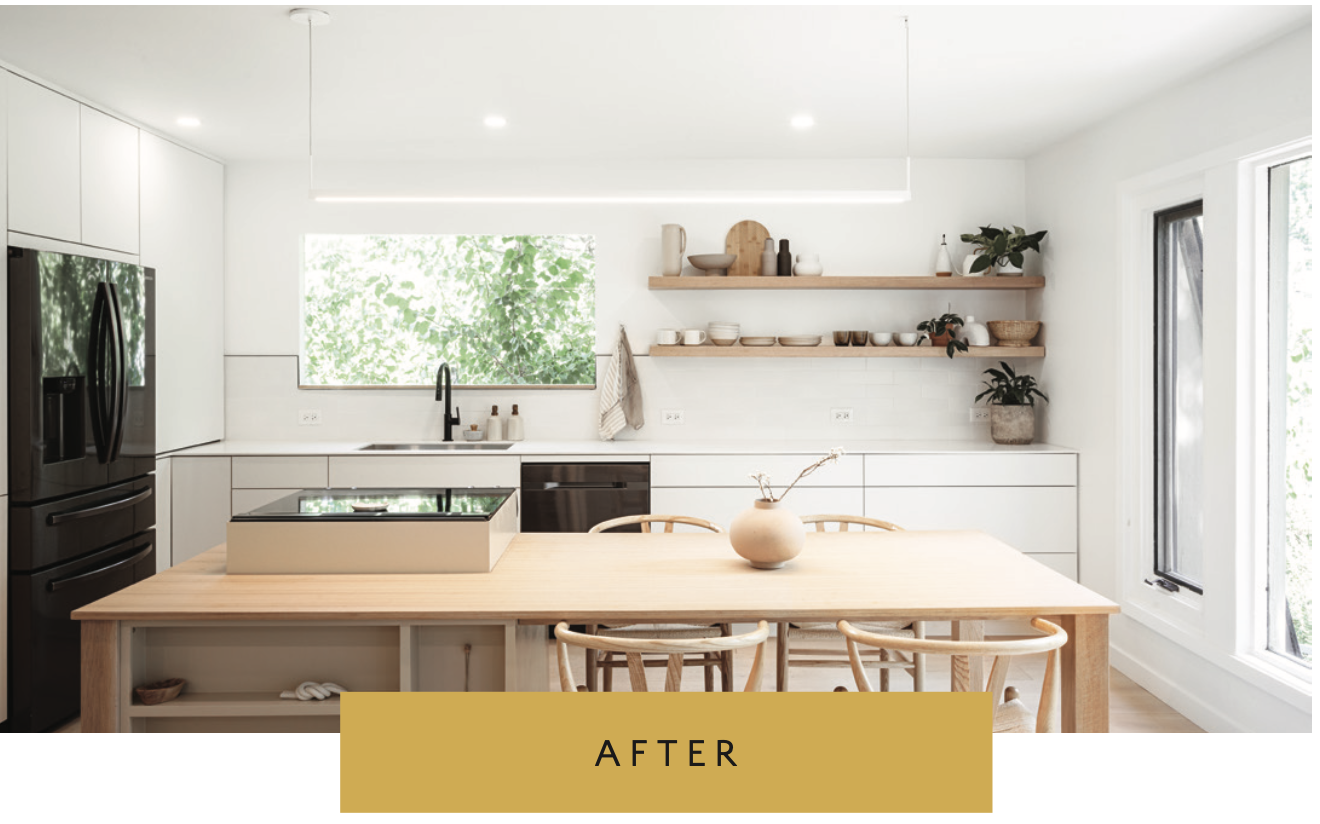

Enhance Your Home Safety in 2022 With These Exterior and Interior Checks

Spring cleaning in 2022: 3 methods designed to declutter your home and mind

The Housing Market Needs More Condos. Why Are So Few Being Built?

If there is a home that you would like more information about, if you are considering selling a property, or if you have questions about the housing market in your neighborhood, please reach out. We’re here to help.