Housing sector is showing signs of picking back up: Powell

Powell said the Fed will "proceed carefully" as whether to tighten further or hold the policy rate constant

In a hawkish tone, Jerome Powell said that Federal Reserve (Fed) officials are prepared to raise the federal funds rate further and hold it at high levels until they are confident that inflation is moving sustainably down to the 2% target. And that’s unclear at this point.

There are some sources of pressure on U.S. prices — among them is the housing market, Powell said Friday morning during an economic policy symposium in Jackson Hole, Wyoming.

“So far this year, GDP [gross domestic product] growth has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust,” Powell said.

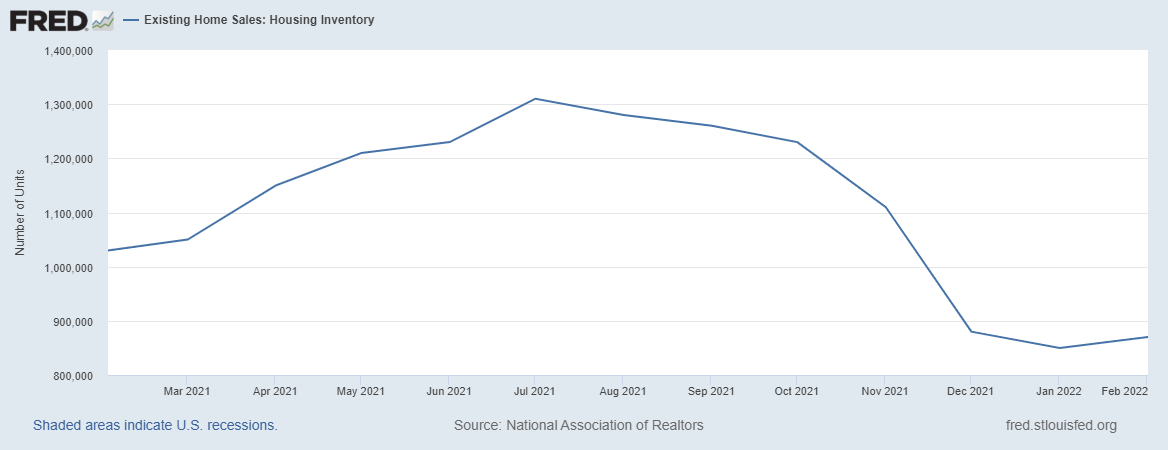

“In addition, after decelerating sharply over the past 18 months, the housing sector is showing signs of picking back up. Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

Powell said that the effects of monetary policy became apparent soon after liftoff in the housing sector. Mortgage rates doubled in 2022, causing housing starts and sales to fall and house price growth to plummet.

In fact, mortgage rates kept an upward trend in 2023, following the Fed’s moves to combat persistent inflation. On Friday, the 30-year fixed mortgage rate was 7.37% at Mortgage News Daily, the highest in over two decades. Economists see rates potentially reaching the 8% level.

Regarding the housing services inflation, Powell said it lagged the monetary tightening. According to him, the main concern here is rents, which have only begun to slow down. “We will continue to watch the market rent data closely for a signal of the upside and downside risks to housing services inflation,” he said.

Other components of inflation show different trends.

Core goods inflation has fallen sharply due to tighter monetary policy and the slow unwinding of supply and demand dislocations. Less sensitive to the Fed moves, nonhousing services, which account for over half of the core PCE and include items such as health care and transportation, have moved sideways since liftoff, Powell said.

The labor market continues to rebalance, with improved supply and moderated demand. This rebalancing has eased wage pressures. The Fed expects the trend to continue, but evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response, Powell said.

Committed to the 2% target

The core PCE inflation index, closely watched by the Fed officials, peaked at 5.4% on a 12-month basis in February 2022 and declined gradually to 4.3% in July 2023.

The lower monthly readings in June and July of 2023 were welcome but only “the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” Powell said.

“We can’t yet know the extent to which these lower readings will continue or where underlying inflation will settle over coming quarters. Twelve-month core inflation is still elevated, and there is substantial further ground to cover to get back to price stability.”

The Fed, however, remains committed to the 2% inflation target, Powell said. It’s challenging to know when such a stance has been achieved in real-time, he remarked.

Despite Powell seeing the current rate as restrictive to the economy, he can’t identify with certainty the neutral rate of interest – the rate at which monetary policy is neither stimulating nor restricting economic growth – which brings uncertainty about how high rates should be. In addition, it’s not clear the duration of the lags with which rate hikes affect economic activity and inflation.

“As is often the case, we are navigating by the stars under cloudy skies,” Powell said. “We will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.”

Subscribe to Housing Wire.